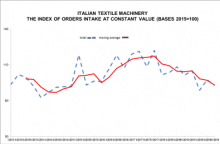

UCIMU Annual Member Meeting: After a slight decrease in 2019 2020 marks a collapse of investments But already in 2021 a recovery is expected

Sesto San Giovanni, 1st October 2020. In 2019, the Italian machine tool manufacturing industry ranked fourth among manufacturing countries and fourth also among exporting countries, overtaken by China that stole its historical third place. On the contrary, its fifth position in the ranking of consumer countries remained unchanged, as a confirmation of the importance of the Italian market in the international scenario. After a 2019 that was certainly not positive, the year 2020 marked a collapse of investments in machine tools, in Italy and abroad, but a consumption recovery is expected already