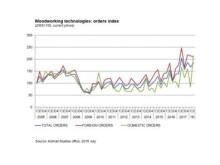

State of the Industry Report 2019: 4th Quarter shows a downturn for the machine tool market

Even in the last quarter 2019, the collection of machine tool orders highlighted a negative sign. In particular, in the fourth quarter 2019, the UCIMU index of machine tool orders registered a 16% downturn compared with the same period of the previous year. The absolute value of the index was 105.5 (base 100 in 2015). The overall outcome was affected both by the negative performance of the domestic market and by the weakness of foreign demand. In particular, the collection of orders in the domestic market showed a 21.2% fall compared with the fourth quarter of 2018. The absolute value of the